How To Put A Line On A Car When They Owe You Money For Something Else

9 Min Read | Aug 26, 2021

Your automobile has been in the store more than in your driveway lately. And you have another big repair on the horizon. You're sick of sinking money into it, simply you're not sure what to practice adjacent.

Exercise yous continue throwing greenbacks into information technology and hope it doesn't break down over again? Or do you sell it and use that money toward another ride? It's a large determination.

The beginning stride in solving a dilemma like this is to do a little math. Don't worry! We'll walk you through it step by step. Your calculations volition betoken you in the right direction and help take the stress out of your controlling!

And the best office? Afterwards yous decide what to practise, nosotros'll evidence yous how to save coin for the repair or your adjacent automobile. Check it out, and then get back to your life—and all the places information technology takes you.

Should I Repair or Replace My Car?

Earlier we get into the numbers, it's important to call up there's always a spectrum when it comes to car repairs. Meaning the math can only testify you so much—like whether you're leaning more toward a repair or replacement. Other factors, such as repair frequency and what you owe on your car, come into play every bit well. Go along these in mind as you lot're running your numbers.

Get-go budgeting with EveryDollar today!

Okay, time to get started. Get-go, judge the value of your motorcar (without repairs). Sites similar Kelley Blueish Book or Edmunds are good examples of resource that can help you with your estimation.* Just for argument'south sake, let'southward say it'south $v,000. And your estimated repair is $1,000. We'll say for this example that the repair will bring the value of your car upwards to $6,000. That may non be the example in every state of affairs, depending on the overall condition of your car and the type of repair. Your mechanic should be able to give yous an idea of how much value your repair will add to your car.

And so in this instance, if you had to sell your car immediately afterward the repair, you'd nevertheless recoup the money you just put into it. In this case, you're probably leaning more toward a repair. At present, if this is your commuter motorcar and you're getting to work late once a week thank you to a breakdown, it might be time to evaluate what these repairs are really costing you—in terms of headaches.

On the other hand, if that initial mechanic bill was closer to $two,000, and the value of the machine increased to only $6,000 with the repair, you're likely leaning toward selling the machine and putting that money toward another car with your $7,000. That way, you're essentially getting a better car for the same money.

Owe more than on your machine than it'southward worth? Hither's what to do most your upside-down car.

If You Want the Prepare: 6 Steps to Pay for Motorcar Repairs

Decided to go ahead with the repair? Your next event is paying for it—because information technology's probably going to toll a not-so-nice chunk of modify. But what if y'all don't take the cash on hand to pay the neb? That's okay. Here are six steps to finding the money you demand to fund your repair:

Stride ane: Shop around.

Don't accept the first quote you're handed. Get the initial diagnosis from a trusted dealership or a larger mechanic shop, but don't assume their price is the cost. The majority of your cost is probably not parts, but labor. And it'south well-nigh always college at larger, more established shops.

To find a reliable mechanic for a lower price, inquire a few friends where they go for trustworthy piece of work. Then call around to find the best toll. While you're on the phone, inquire about any current discounts and specials they might offer too.

Step two: What tin can yous do yourself?

Maybe you lot need new brakes, just you too demand to supercede the door handle that came off this morning.Why not become the brakes fixed at the shop, and find an after-market replacement for your door handle online? Then spotter a YouTube video and set it yourself. Simply be certain to follow the directions very carefully.

Step 3: What can wait?

If the estimated repair is still out of your condolement zone, inquire the mechanic what needs to be fixed now and what can wait a few months. Don't skip important safety features like brakes, tires and timing belts. Merely yous tin can alive without automatic windows for a while.

Step 4: Make a budget.

Allow's say you've lowered the repair toll as much as possible. Now information technology'due south time to discover the cash to pay your bill. We recommend making a zero-based upkeep before you first overturning your couch cushions in search of loose change. You tin make a budget in about 10 minutes with our favorite budget app, EveryDollar. It's free, and information technology's a style less labor-intensive than digging through your sofa.

Step 5: Move your coin.

If you're withal coming up brusque, no problem. Just dial your budget dorsum in nonessential areas like restaurants, haircuts and new clothes. You can too divert your savings temporarily. And as a very last resort, you lot can use your emergency fund for absolutely necessary repairs. Only restock it every bit soon as possible.

Step vi: Budget for future repairs.

Ensure this outcome doesn't happen to you over again by creating a line item in your budget for future car repairs and maintenance. That fashion, the money will be there waiting for you lot when you need it—and you will.

If You lot Want a Replacement: Should You lot Lease, Purchase New, or Buy Used?

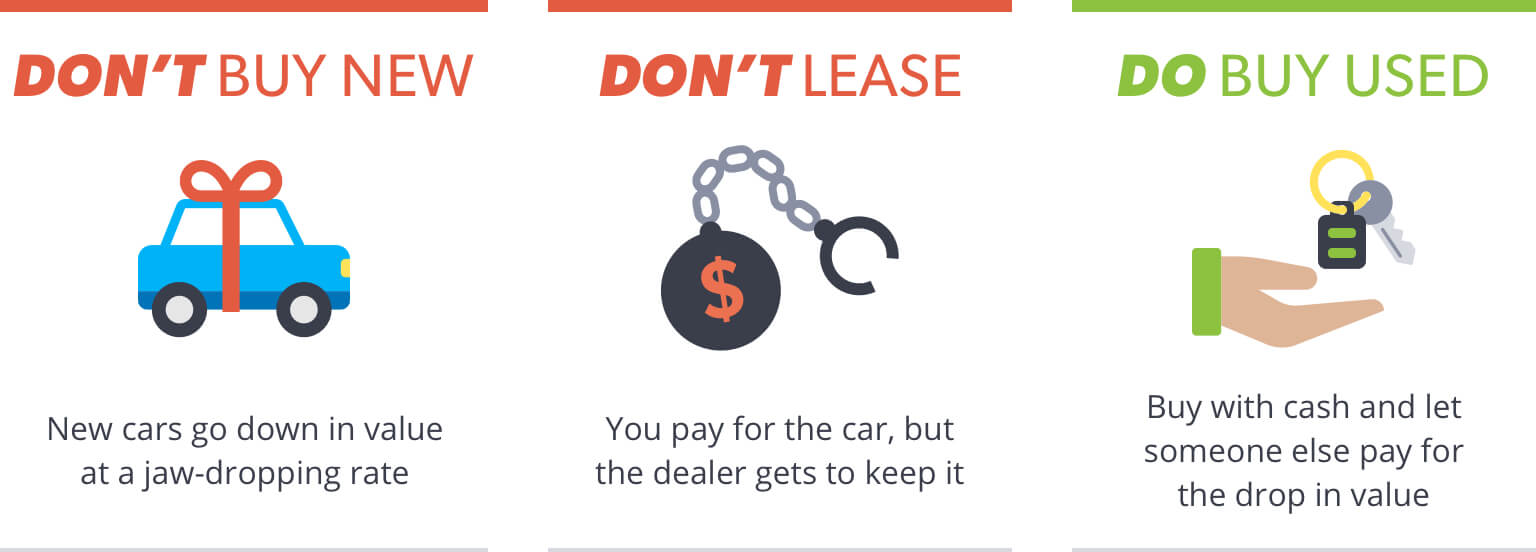

Let'south say y'all've decided it's non worth information technology to repair your current motorcar. You're ready for something else. While it's tempting to want your next car to be new and nether warranty (read: no repairs!), the last affair you want to do is caput to the nearest new auto dealership. Here's why:

New Cars.

The depreciation on a new vehicle is jaw-dropping. A $xx,000 car will be worth about $8,000 in five years.[one] That's a lx% decrease! Fifty-fifty after but one yr, the automobile could go down in value as much as 25%. And so unless you lot have a net worth over $1 meg, don't buy new—ever. Let someone else absorb the depreciation.

Leased Cars.

A charter is just the most expensive way to operate a motorcar. Every month, your lease payment goes to cover the car's depreciation plus the dealer's profit. At the end of the lease, y'all have cipher disinterestedness in the motorcar, merely y'all practise have the option to purchase it. That may or may not be a skillful deal since the buy price is set at the beginning of the lease and isn't based on the actual value of the car at the cease of the lease. Then there are the fees—a fee y'all'll pay if you exceed a certain number of miles or have excessive wear and tear on the car, a fee you'll pay if you decide not to buy the car when your lease is up, and a fee y'all'll pay if you exercise decide to purchase it. All that adds upwardly to a practiced deal for the dealer—not for you.

Used Cars.

Your best bet is to buy an affordable, used car with the money you accept saved (combined with the cash from the sale of your current auto). That manner you own the car, rather than information technology owning you. Used car doesn't hateful crap car; it just means you lot're smart enough to permit someone else pay for that initial drop in value. Ownership used is the only manner to go.

Detect out how to go the best bargain on a car you love! Download our complimentary Machine Guide today!

How to Pay for a Car in Cash

Don't get into debt for a car. It's simply not worth it. That will but give you more grief down the road. Retrieve, all cars demand repairs and maintenance somewhen. With a loan, you'll have a monthly automobile payment and repair bills on top of that.

Don't go into debt for a auto. Information technology'southward just not worth it.

So how exactly do you live without a machine payment and however get the car of your dreams? The key is in your approach to saving money. Here's a strategy we love:

1. Save Your Automobile Payment.

Go ahead and buy the car yous can afford with the cash you have on hand—permit'due south say it'due south $5,000. That can go you around for at least x months or so. And then take $500—the average monthly payment on a new machine—and relieve it every month.[2]

2. Sell Your Automobile and Combine Your Savings.

Afterward ten months of doing that, y'all'll have built your car-buying budget support to $5,000. Add that to the cash y'all get from the sale of your electric current car (let's say $four,000), and you accept $9,000 for a new ride. That'due south a major upgrade in car in merely 10 months—without owing the depository financial institution a dime!

3. Proceed Saving and Upgrading.

Just the fun doesn't accept to end there. If you keep consistently putting the aforementioned corporeality of coin away, 10 months later you'll have another $5,000 to put toward a car. Yous could probably sell that $ix,000 vehicle for a trivial less than you paid ten months before—meaning you'd likely have around $13,000 to pay for a motorcar, merely 20 months after this whole process started.

The bottom line is this: At that place's a lot you could do with an extra $500 a month!

The less money you're spending on your motorcar, the more than money yous have to put toward more important things, like your kids' higher fund, your retirement, and paying back those old student loans. It'south okay to own a prissy auto—just don't allow your motorcar own you.

In fact, don't let any of your stuff—or fifty-fifty your money—own you lot. Y'all're the one in charge here! Yes—y'all. If you want to learn how to take control of your coin for good, give Ramsey+ a test-drive. You'll get all the tools and all the teachings you need to make your money work for you, instead of the other way effectually. And right now, you can try Ramsey+ in a free trial. Blast.

*Kelley Bluish Book and Edmunds are not in whatsoever manner affiliated with the publisher of this content. The site links provided are for reference but and not an endorsement of any production or service. No warranty or representation is made regarding these third party sites or services.

Nearly the author

Ramsey Solutions

Source: https://www.ramseysolutions.com/budgeting/should-i-repair-or-replace-my-car

Posted by: cotetion1988.blogspot.com

0 Response to "How To Put A Line On A Car When They Owe You Money For Something Else"

Post a Comment